Category: Economics

Matters of money

Open thread: Bitcoin and similar cryptocurrencies

This article is a good explanation of how the Bitcoin protocol actually works. This one describes some of the problems the Bitcoin system is experiencing.

Open thread: marine protected areas

I have written a number of times before about the unsustainable nature of global fisheries and the sorts of policies that might help combat that.

Marine protected areas have an important role to play in that effort. They constitute sanctuaries in which fish are protected from the hugely destructive fishing technology that is now deployed. Their more extensive establishment could play an important role in maintaining the viability of many important species.

An eminent visitor

As he headed upstairs for lunch in the private dining room at Massey College today, I was able to hand a short letter about climate change to Prime Minister Stephen Harper. He accepted it very graciously and suggested we pose for a photo. I also gave a copy of the letter to Master Fraser, who was accompanying him.

New carbon infrastructure in B.C.

British Columbia has a carbon tax, but it doesn’t seem to be taking to heart the need to stop building new infrastructure for the carbon economy:

B.C.’s north is in a frenzy of planning. There are applications for port expansions, coal and mineral mines, oil terminals, pipelines, synthetic fuel plants, liquefied natural gas facilities and hundreds of new drill rigs for shale gas extraction. Pinned on a map, the proposals create a porcupine of industrial intentions.

Hopefully, growing awareness about how wasteful and destructive it would be to build these things will keep it from actually happening.

Toronto350.org “Do the Math” screenings tomorrow

There are still tickets available for both of tomorrow’s screenings of the climate change documentary “Do the Math” at the Bloor Cinema in Toronto.

Along with the film, there will be a panel discussion featuring Green Party leader Elizabeth May and Adria Vasil.

If you know anyone in Toronto who is environmentally inclined or concerned about climate change, please let them know about the event.

Series on the causes of the 2008 financial crisis

Each of these is worth reading:

The Varsity on fossil fuel divestment

In todays’ edition of The Varsity, there is an interview about the Toronto350.org divestment campaign at the University of Toronto.

In addition to quoting me and the Office of the President, it quotes Justin Lee, president of U of T’s Rational Capital Investment Fund, claiming that we are needlessly politicizing the issue of investment and implying that divestment would be bad for the portfolio. I wish he had read section 4 of the brief, in which we explain why divestment is a smart idea financially. These investments are not compatible with long-term prosperity for the world, since the business plans of these companies are focused on activities that would guarantee dangerous climate change. They are also incompatible with the long-term prosperity of the university itself, since the assumption that these companies will be able to burn all the fuel they own will eventually be invalidated.

Also, the fact that the university has a divestment policy in the first place shows that they understand how their investment choices do have ethical implications which are rightly a concern of the school. This isn’t a matter of needlessly politicizing university investment – it’s about bringing U of T’s investment policy in line with its values and long-term financial interest.

Thinking of going phone-free

My three-year iPhone contract ends in February, and I am thinking about selling the phone. I am tempted to go entirely phone-free, but there are times when having a phone is necessary to get information (like when things are available for pickup) or for coordinating meetings.

Part of my reluctance to continue with smartphones is the cost. My monthly bills were consistently over $100 until I called Fido to try to cancel and they switched me onto a $60 ‘retention’ plan, which provided more than my previous $100 plan.

Another major motivation is distraction. One part of that is the annoyingly intrusive character of all phones. They allow anybody to demand your immediate attention at any time. Mine is usually on ‘airplane mode’ or off, but that doesn’t entirely eliminate the anxiety, since there is always a nagging sense in my mind that someone might be setting down a batch of missed calls.

A bigger distraction issue comes from just having a smartphone with you. Ordinarily, that means getting periodically interrupted by texts and emails. More subtly, there is the constant temptation to take a peek at the news, have a glance at Twitter, and the like. It takes a person out of the present moment, which makes relatively unpleasant tasks like comp prep more difficult and makes relatively pleasant tasks like walking on a cool fall afternoon less immersive.

The constant tracking and NSA / CSEC paranoia is another cause for skepticism about cell phones.

Going phone-free is probably a bridge too far. I would go with that option if I had someone who could take the occasional message for me and pass it on by email, but I don’t want to burden anyone with that, at least until I get an unpaid intern or two. More plausibly, I will get a very small, very cheap pay-as-you go phone for very occasional use.

It’s hard to say whether three years with the iPhone has provided good value for money. It’s certainly a capable device – especially when traveling – and I have made extensive use of the camera, email functionality, tethering capability, Google Maps connectivity, and web access. At $100 per month for most of the span, the total cost to date has been over $3500 – as much as a 5D Mark III (before battery grip and other necessary extras), or a couple of Fuji X100S cameras (one of which would be a gratuitous 30th-birthday-gift-to-self if I had the funds).

Once my contract ends, I think I can shift to paying month-by-month. As a trial, I may try cancelling it for 2-3 months without selling the phone and testing my experience with the pay-as-you-go option. At that point, I can re-evaluate.

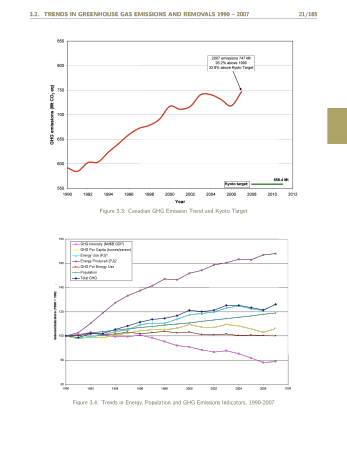

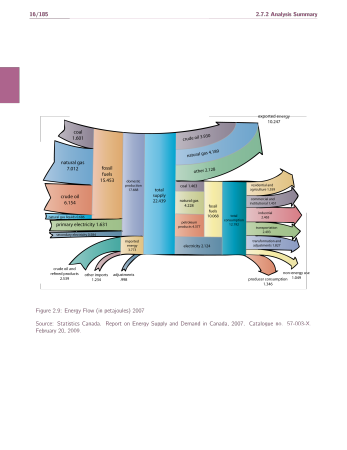

Canada’s greenhouse gas trends and breakdown

Interesting material:

For one thing, it shows what a huge quantity of GHG pollution Canada exports in the form of fossil fuels.

From Canada’s Fifth National Communication on Climate Change. 2010. http://unfccc.int/resource/docs/natc/can_nc5.pdf