If there is one thing the ongoing financial crisis demonstrates, it is the need for fiscal discipline. The causes of the crisis call attention to the more problematic characteristics of debt. At the same time, the prospect of bank failures and the curtailing of lending highlight the degree to which debt has a legitimate and important financial role to play. In short, debt incurred to finance investment is often justifiable; debt used to finance consumption is unsustainable.

Perhaps a healthy cultural outcome of the crisis would be the re-stigmatization of debt as a means of accelerating consumption. By all means, it is important for people to be able to access financing in order to fund education and other forms of investment. What is worrisome is the tendency towards low or even negative net savings, as well as taking on debt of an especially pernicious sort: on credit cards. Taking responsibility and making informed choices remains necessary, even if governments choose to regulate financial markets more closely.

People with a clean credit history who are paying credit card interest really ought to look into alternative financing options. Credit card interest rates are often around 20% per year, and minimum monthly payment amounts are just 2% of the outstanding total. That means your debt is growing by 1.67% per month, and you are paying it down by just 2%. The amount of principal being paid off each month is tiny.

Someone who put $1000 on a card with 20% interest, then proceeded to make minimum payments only, would have the debt down to $500 after 210 months (17.5 years), having paid $3043. Sticking to minimum payments, there is still $40 left after 1000 months (83 years), by which time the person would have paid $5838. The credit card company would be delighted for them to keep paying forever. Just by paying off 10% of the balance each month, instead of 2%, the time taken to reduce the debt to $50 becomes 36 months (3 years), at a total cost of $1148.

Both borrowing and lending are activities that need to be undertaken with wisdom and restraint. Hopefully, that will be the message that governments and individuals draw from the world’s present economic woes.

Fiscal discipline!

What cadence!

Here are the calculations relating to this post.

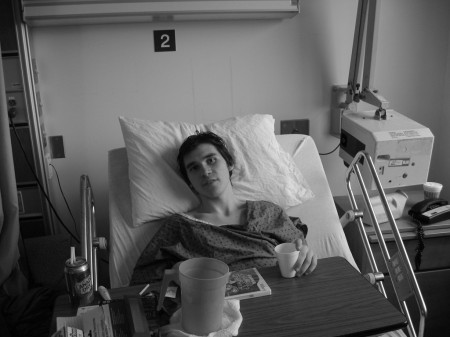

…poor Sasha.

If you are disciplined, you can do well with credit cards. I have always paid my balance in full, so I have never paid any interest. I also get Air Miles for purchases.

Who’s in the hospital?

If there was no debt, there would be no money. Money is only created when treasury bills are sold to a central bank. And circulating money is only created when that money is used as the basis of fractional reserve loans given to regular banks.

There is another reason, however, that the savings rate is catastrophically lower than it was in the early 80s – interest rates are too low. Why would you invest money when the rate you can earn on it is barely higher than inflation? You will always be better off borrowing money if you can earn a better return on physical capital than you can on invested capital.

Lowering interest rates at the outset of a recession creates the opposite incentive than is needed. “Stigmatization” is less important than the economic reality that an investment now, for example, a GIC, is almost certainly going to lose money because the very thing that keeps the interest rates down – the increase in the money supply – creates inflation which cancels out the rate of return earned on low interest investments. And high-interest investments, well no one seems very excited about those right now.

There are plenty of non-profit groups that exist to help people consolidate credit card rate at lower rates.

There is a bit of a contradiction between eliminating (or making irrelevant) usury legislation, which allows credit cards to create the conditions for the financial ruin of the economic intelligence challenged, and then on the other hand artificially fix interest rates very low, which increases the money supply, causing inflation, and thereby reducing wages. The state should choose whether to regulate or not to regulate interest rates, and have a policy which is consistent across the board.

…poor Sasha.

Indeed. He and I are playing Super Mario Galaxy in his rez room now.

Who’s in the hospital?

My brother Sasha.

See: Montreal hospital experiences

Does being right matter?

Category: mainstream media – multi-media – politics

Posted on: November 25, 2008 2:48 PM, by coby

Okay, so this clip is a bit long (~10 minutes) and it is mostly Fox Noise, but it is really fascinating to watch this one guy, Peter Schiff, being dead on in his economic predictions and advice over and over and over again, and even more interesting to watch the the boobleheads laugh at him and wisely wag their fingers.

Why growth is essential to keeping the current debt-based financial system operating

“It looks to me as though that we are due for a debt unwind, and with it a rapid decline in the US standard of living. Exactly what form it will take, and what the timing will be (for example, sudden one month from now or sudden three years from now, or gradual over a longer period), isn’t certain. I would expect that many (or most) other economies in the world will be dragged along in this debt unwind and will experience a decline in their standards of living.”

Public debt

The biggest bill in history

Jun 11th 2009

From The Economist print edition

The right and wrong ways to deal with the rich world’s fiscal mess

THE worst global economic storm since the 1930s may be beginning to clear, but another cloud already looms on the financial horizon: massive public debt. Across the rich world governments are borrowing vast amounts as the recession reduces tax revenue and spending mounts—on bail-outs, unemployment benefits and stimulus plans. New figures from economists at the IMF suggest that the public debt of the ten leading rich countries will rise from 78% of GDP in 2007 to 114% by 2014. These governments will then owe around $50,000 for every one of their citizens (see article).

Not since the second world war have so many governments borrowed so much so quickly or, collectively, been so heavily in hock. And today’s debt surge, unlike the wartime one, will not be temporary. Even after the recession ends few rich countries will be running budgets tight enough to stop their debt from rising further. Worse, today’s borrowing binge is taking place just before a slow-motion budget-bust caused by the pension and health-care costs of a greying population. By 2050 a third of the rich world’s population will be over 60. The demographic bill is likely to be ten times bigger than the fiscal cost of the financial crisis.

usdebtclock.org

Economic frame of reference

SIR – I was struck by your leader on debt, not so much for its conclusions, but by its language (“The biggest bill in history”, June 13th). You used the adjective “rich” no less than seven times to describe countries that now stagger under a monumental weight of indebtedness. By the same token, the adjective “emerging”, when used with reference to developing nations, seems almost pejorative, given that so many of these countries now have better prospects for economic growth: zestier demographics, larger foreign reserves, dramatically reduced sovereign-debts, stabler banking systems, and superior household finances and savings rates.

Could there be a more accurate way to describe the supposedly rich economies? If not “poor”, then how about “grievously indebted”?

Tim Price

Director of investment

PFP Wealth Management

London

Hurry Up and Wait

Liberal economists think we should reduce the deficit. Just not yet.

By Christopher Beam

Posted Wednesday, Sept. 30, 2009, at 11:39 PM ET

When it comes to the national debt, says Paul Krugman, the best advice may come from St. Augustine: “Grant me chastity and continence—but not yet.” That was the rough consensus among the economists who convened Wednesday at the Washington Court Hotel for a conference held by the Center for American Progress and the Center for Budget and Policy Priorities: We absolutely have to do something about this deficit. Just not right now.

Their advice is on the merits, but it just so happens to be politically convenient. We wanted to reduce the deficit, the White House and congressional Democrats can say, but the experts told us not to! In economics as in politics, timing is everything.

Before the economists gave the politicians permission not to act right away, however, they established the need to do something eventually. Right now, CBPP President Robert Greenstein said, the annual deficit is about 8 percent of gross domestic product, while the national debt—the sum of all past deficits—is about 70 percent of GDP, or $10 trillion. If current policy persists, the deficit will inflate to become 20 percent of GDP by 2050, with a total national debt of 300 percent of GDP. (The main reason for the ballooning deficit is Medicare and Medicaid spending, but Social Security plays a role, too.)

Squawking Hawks

The current deficit debate is for the birds.

By Daniel Gross

Posted Thursday, Nov. 5, 2009, at 2:21 PM ET

Much of the horrific explosion in the national debt—the deficit soared from $248 billion in 2006 to $1.4 trillion in the recently concluded Fiscal Year 2009—can be pinned on cyclical factors. When the economy goes in the tank, it creates a fiscal double whammy, gutting tax receipts and boosting demand for government spending programs that are both ordinary (increasing unemployment benefits) and extraordinary (bailouts, stimulus). Spending rose 18 percent and revenues fell 16.6 percent in fiscal 2009—the worst decline seen since the 1930s, with corporate income taxes plummeting 55 percent. Had revenues been steady, the deficit would have been only (only, he said) $1 trillion.

But signs of recovery returned with the spring. As the financial system came back from the brink, banks paid back billions in TARP funds. In its mid-session review, issued in late July, the Office of Management and Budget dialed back its estimate for the fiscal 2009 deficit from $1.84 trillion in May to $1.58 trillion, due in large part to the trimming of cash piles set aside to help Wall Street. The stock market rally, recovering corporate profits, and an economy that began to expand at a 3.5 percent rate in the summer have translated into higher-than-expected tax receipts. And so, as the treasury department’s Financial Management Service reported, the final numbers came out better both on spending and receipts—with a $1.42 trillion deficit, $138 billion smaller than was forecast in July.

Buttonwood

Voting away your debts

Jan 7th 2010

From The Economist print edition

The Iceland saga is a harbinger of crises to come

THERE are many ways to decide whether to repay your debts but a national referendum is surely a first. That is what is going to happen in Iceland after its president refused to sign a bill paying €3.8 billion ($5.5 billion) to the British and Dutch governments over 15 years.

Given that a quarter of the Icelandic population has signed a petition opposing such payments, it is not difficult to imagine how such a poll will turn out. “Vote for lower incomes” is not going to be a very popular slogan. And the Icelanders will only be the first. Around the world governments have assumed the debts of their private sectors. That is an easy commitment to make in the short term. Paying the money back is another matter. If the debt is large enough, the result will be years of austerity. Electorates will choke at the cost.

Countries will initially be reluctant to default on their sovereign debt (although there have been plenty of examples in the past). But things are different in cases where there is scope for a state to question its responsibility to repay. That was the case with the debts of Dubai World, which the city-state claimed were not government-backed (Abu Dhabi, Dubai’s fellow emirate, eventually agreed to help out). And it is also the case with Iceland.

What Caused the Economic Crisis?

The 15 best explanations for the Great Recession.

By Jacob Weisberg

Updated Saturday, Jan. 9, 2010, at 6:59 AM ET

There are no strong candidates for what logicians call a sufficient condition—a single factor that would have caused the crisis in the absence of any others. There are, however, a number of plausible necessary conditions—factors without which the crisis would not have occurred. Most analysts find former Fed Chairman Alan Greenspan at fault, though for a variety of reasons. Conservative economists—ever worried about inflation—tend to fault Greenspan for keeping interest rates too low between 2003 and 2005 as the real estate and credit bubbles inflated. This is the view, for instance, of Stanford economist and former Reagan adviser John Taylor, who argues that the Fed’s easy money policies spurred a frenzy of irresponsible borrowing on the part of banks and consumers alike.

Liberal analysts, by contrast, are more likely to focus on the way Greenspan’s aversion to regulation transformed pell-mell innovation in financial products and excessive bank leverage into lethal phenomena. The pithiest explanation I’ve seen comes from New York Times columnist and Nobel Laureate Paul Krugman, who noted in one interview: “Regulation didn’t keep up with the system.” In this view, the emergence of an unsupervised market in more and more exotic derivatives—credit-default swaps (CDSs), collateralized debt obligations (CDOs), CDSs on CDOs (the esoteric instruments that wrecked AIG)—allowed heedless financial institutions to put the whole financial system at risk. “Financial innovation + inadequate regulation = recipe for disaster is also the favored explanation of Greenspan’s successor, Ben Bernanke, who downplays low interest rates as a cause (perhaps because he supported them at the time) and attributes the crisis to regulatory failure.

A bit farther down on the list are various contributing factors, which didn’t fundamentally cause the crisis but either enabled it or made it worse than it otherwise might have been. These include: global savings imbalances, which put upward pressure on U.S. asset prices and downward pressure on interest rates during the bubble years; conflicts of interest and massive misjudgments on the part of credit rating agencies Moody’s and Standard and Poor’s about the risks of mortgage-backed securities; the lack of transparency about the risks borne by banks, which used off-balance-sheet entities known as SIVs to hide what they were doing; excessive reliance on mathematical models like the VAR and the dread Gaussian copula function, which led to the underpricing of unpredictable forms of risk; a flawed model of executive compensation and implicit too-big-to-fail guarantees that encouraged traders and executives at financial firms to take on excessive risk; and the non-confidence-inspiring quality of former Treasury Secretary Hank Paulson’s initial responses to the crisis.

“To pinpoint where more squeezing is likely, the study examined how far the level and growth of debt in different sectors were out of line with other countries and with historical averages. It also looked at measures of borrowers’ capacity to service their debts and their vulnerability to income shocks. On this basis it could assess where the chances of more deleveraging over the next couple of years are high, moderate or low (see chart). Half of the ten rich countries in the report’s sample have one or more sectors that are “highly” vulnerable to more debt reduction. Not surprisingly, these include households in America, Britain, Spain and, to a lesser degree, Canada and South Korea, as well as commercial property in America, Britain and Spain. With a high risk of more corporate and financial deleveraging as well, Spain has the rockiest road ahead. No country in the sample has much chance of government-debt reduction over the next couple of years.”

“Some general elections mark the end not only of governments but of historical eras too. The one in 1945 signified the end of pre-war social atomisation and adumbrated the birth of the welfare state; the election of 1979 marked the demise of the post-war economic settlement. The election called by Gordon Brown after his visit to the queen on April 6th also coincides with the end of an era: the passing of the era of free stuff. The contest will in a sense be a referendum on that giddy age; its freebies and excesses—big and small, public and private, enjoyed by rich and poor alike—will loom over the campaign. The new era that lies on the other side of polling day, however, is less well defined.

The big free stuff includes much of the infrastructure upgrade of the past decade. Many of the new schools, hospitals and other gleaming facilities of which Labour will boast in the next month were constructed under the private-finance initiative, and so have largely not been paid for yet. And the country has belatedly realised that it hasn’t settled the bill in full even for those things it thought it had bought upfront. Instead the government ran a fiscal deficit that was irresponsible in the fat years and became calamitous in the lean ones. Last year it was £167 billion, or 11.8% of GDP. Debt is the elephant in the polling booth.”

OP-ED CONTRIBUTOR

Easy Money, Hard Truths

By DAVID EINHORN

Published: May 26, 2010

Are you worried that we are passing our debt on to future generations? Well, you need not worry.

Before this recession it appeared that absent action, the government’s long-term commitments would become a problem in a few decades. I believe the government response to the recession has created budgetary stress sufficient to bring about the crisis much sooner. Our generation — not our grandchildren’s — will have to deal with the consequences.

According to the Bank for International Settlements, the United States’ structural deficit — the amount of our deficit adjusted for the economic cycle — has increased from 3.1 percent of gross domestic product in 2007 to 9.2 percent in 2010. This does not take into account the very large liabilities the government has taken on by socializing losses in the housing market. We have not seen the bills for bailing out Fannie Mae and Freddie Mac and even more so the Federal Housing Administration, which is issuing government-guaranteed loans to non-creditworthy borrowers on terms easier than anything offered during the housing bubble. Government accounting is done on a cash basis, so promises to pay in the future — whether Social Security benefits or loan guarantees — do not count in the budget until the money goes out the door.

A good percentage of the structural increase in the deficit is because last year’s “stimulus” was not stimulus in the traditional sense. Rather than a one-time injection of spending to replace a cyclical reduction in private demand, the vast majority of the stimulus has been a permanent increase in the base level of government spending — including spending on federal jobs. How different is the government today from what General Motors was a decade ago? Government employees are expensive and difficult to fire. Bloomberg News reported that from the last peak businesses have let go 8.5 million people, or 7.4 percent of the work force, while local governments have cut only 141,000 workers, or less than 1 percent.

“IN HINDSIGHT one of the worst things about America’s subprime housing bust is how predictable it was. Subprime borrowers were by definition people of limited means with poor credit histories. Yet economists who have looked at the pattern of payments on subprime mortgages point out that even when house prices topped out and then began to fall, not all subprime borrowers defaulted. Only a minority of borrowers abruptly ceased to make payments, as someone choosing to default would.

More typically, payments went from being regular to being erratic: borrowers fell behind, then became current again, only to fall behind once more. Those patterns are indicative of people trying, but struggling, to keep up with their payments. A trio of economists set out to find out what differentiated those borrowers who did not keep up with their payments from the rest. Their answer, according to a new working paper from the Federal Reserve Bank of Atlanta, is simple: numeracy.”

The age of easy credit and its aftermath

Is there life after debt?

Rich countries borrowed from the future. Paying the bill will be difficult, and so will living in a thriftier world

Jun 24th 2010

DEBT is as powerful a drug as alcohol and nicotine. In boom times Western consumers used it to enhance their lifestyles, companies borrowed to expand their businesses and investors employed debt to enhance their returns. For as long as the boom lasted, Mr Micawber’s famous injunction appeared to be wrong: when annual expenditure exceeded income, the result was happiness, not misery.

For a long time debt in the rich world has grown faster than incomes. As our special report this week spells out, it is not just government deficits that have swelled. In America private-sector debt alone rose from around 50% of GDP in 1950 to nearly 300% at its recent peak. The origins of the boom go even further back, reflecting huge changes in social attitudes. In the 19th century defaulting borrowers were sent to prison. The generation that lived through the Great Depression learned to scrimp and save. But the wider take-up of credit cards in the 1960s created a “buy now, pay later” society. Default became just a lifestyle choice. The reckless lender, rather than the imprudent debtor, was likely to get the blame.

As consumers leveraged up, so did companies. The average bond rating fell from A in 1981 to BBB- today, just one notch above junk status. Firms that held cash on their balance-sheets were criticised for their timidity, while bankruptcy laws, such as America’s Chapter 11, prevented creditors from foreclosing on companies. That forgiving regime encouraged entrepreneurs (in Silicon Valley a bankruptcy is like a duelling scar in a Prussian officers’ mess) but also allowed too many zombie companies to survive (look at the airlines). And no industry was more addicted to leverage than finance. Banks ran balance-sheets with ever lower levels of equity capital; private equity and hedge funds, which use debt aggressively, churned out billionaires. The road to riches was simple: buy an asset with borrowed money, then sit back and watch its price rise.

Credit card fees transfer wealth to rich: Fed

People who pay by cash subsidize those using cards, study says

http://www.theglobeandmail.com/report-on-business/credit-card-fees-transfer-wealth-to-rich-fed/article1652086/

“Credit card fees and rewards programs exacerbate income inequality by acting as a transfer of wealth from poor to rich, according to a Federal Reserve Bank of Boston study released Monday.

The researchers argue that reducing card rewards and merchant fees “would likely increase consumer welfare.”

Merchants usually don’t charge different prices for card users to recover the costs of fees and rewards, but instead, mark up the prices for all consumers.

As a result, people who pay cash – and who are more likely to be lower income – end up subsidizing those who pay by credit card.

U.S. consumer finance data show that people on a low income are less likely to have a credit card, and those who do spend less a month on average than higher earners. High-income consumers are also 20 percentage points more likely to receive credit card rewards – be they frequent flier miles, cash back or other enticements.

“What most consumers do not know is that their decision to pay by credit card involves merchant fees, retail price increases, a nontrivial transfer of income from cash to card payers, and consequently a transfer from low-income to high-income consumers,” Scott Schuh, Oz Shy and Joanna Stavins wrote.

They found that about 83 per cent of banks’ revenue from credit card fees is obtained from cash payers “and disproportionately from low-income cash payers.””

The right way up

SIR – You suggested allowing bankruptcy judges and special trustees to write down balances of loans for homeowners in America who are upside down in their mortgages (“Are we there yet”, September 18th). This ignores the fact that a loan balance represents dollars belonging to someone, either an investor or bank depositor, used to support the purchase of collateral property. Who would absorb the shortfall if this was allowed?

As a banker, I’m sympathetic to those borrowers who are in this upside-down situation. We try to help our customers through these troubled times. But there is a great difference in our attempts to assist these borrowers and any situation which would give them an entitlement to have their loan obligation reduced. There has always been a moral, as well as a financial, obligation to repay loans. If we begin to take steps to set aside that moral obligation, the troubles we see today will pale in significance.

Joe F. Ferguson

Chief executive

Stephens Federal Bank

Toccoa, Georgia

TARP Investment Earned Taxpayers 8.2% in Two Years

By HUGH COLLINS

The TARP bailout of financial firms has yielded a return of 8.2% in two years.

This return, $25.2 billion on an investment of $309 billion, beats what could have been gained by U.S. Treasuries, high-yield savings accounts and certificates of deposit, Bloomberg News reported.

Sponsored Links

When it was first announced, the TARP program was expected to cost the taxpayer billions of dollars. It is still expected to make a loss overall, but the money ploughed into the banks and insurance companies has been unexpectedly profitable.

“From the perspective of the taxpayers getting their money back, TARP has been a great success,” Todd Petzel, chief investment officer at New York-based Offit Capital Advisors LLC told Bloomberg News.

When it became clear that people could not pay back what was owed, the rules of the game changed. Bankruptcy laws were amended in 2005 to introduce a system of “partial indentured servitude.” An individual with, say, debts equal to 100 percent of his income could be forced to hand over to the bank 25 percent of his gross, pre-tax income for the rest of his life, because the bank could add on, say, 30 percent interest each year to what a person owed. In the end, a mortgage holder would owe far more than the bank ever received, even though the debtor had worked, in effect, one-quarter time for the bank.

When this new bankruptcy law was passed, no one complained that it interfered with the sanctity of contracts: At the time borrowers incurred their debt, a more humane—and economically rational—bankruptcy law gave them a chance for a fresh start if the burden of debt repayment became too onerous.

That knowledge should have given lenders incentives to make loans only to those who could repay them. But lenders perhaps knew that, with the Republicans in control of government, they could make bad loans and then change the law to ensure that they could squeeze the poor.

Obama urges $450-billion stimulus package to spur economy

Buttonwood

Running out of options

Governments in the rich world have painted themselves into a corner

ECONOMIC policy in the developed world over the past 25 years has followed one overriding principle: the avoidance of recession at all costs. For much of this period monetary policy was the weapon of choice. When markets wobbled, central banks slashed interest rates. A by-product of this policy was a series of debt-financed asset bubbles. When the last of those bubbles burst in 2007 and 2008, the authorities had to add fiscal stimulus and quantitative easing (QE) to the policy mix.

The subsequent huge rise in budget deficits was largely the result of a collapse in tax revenues that had been artificially inflated by the debt-financed boom. Britain and America ended up with deficits of more than 10% of GDP, shortfalls that were unprecedented in peacetime.

Those deficits may have been necessary to avoid a repeat of the Depression. Economists will probably still be debating this issue in 75 years’ time, just as they still discuss whether Franklin Roosevelt’s New Deal programme was effective in the 1930s. But the “shock and awe” approach to Keynesian stimulus has an unfortunate consequence. Any decline in the deficit, even to a still whopping 8% of GDP, acts as a contractionary force on the economy: either the government is spending less or taxing more.

He proposes an entirely different explanation for the Great Depression and the current crisis. Both events, he says, were triggered by a collapse in debt-financed demand. Aggregate demand in an economy like ours is composed of GDP plus the change in the level of debt. It is the sudden and extreme change in debt levels that makes demand so volatile and triggers recessions. The higher the level of private debt, relative to GDP, the more unstable the system becomes. And the more of this debt that takes the form of Ponzi finance – borrowing money to fund financial speculation – the worse the impact will be.

Keen shows how, from the late 1960s onwards, private sector debt in the US began to exceed GDP. It built up to wildly unstable levels from the late 1990s, peaking in 2008. The inevitable collapse in this rate of lending pulled down aggregate demand by 14%, triggering recession.