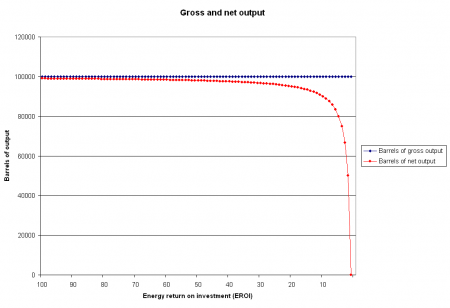

This chart demonstrates one characteristic of a changing energy return on investment (EROI). This is the ratio between how much energy is takes you to produce or acquire an energy source (such as oil, natural gas, biofuel, or hydrogen) and the amount of energy contained within it. This graph relates to a hypothetical oil field that is consistently able to produce 100,000 barrels per day of oil. On the left hand side, the EROI is 100:1. This means that you get 100 units of usable energy for every 1 unit you invest in extraction. This ratio is comparable to some of the best oilfields in Kuwait, where you just need to drill a hole and oil will gush out. On the right, the EROI falls towards 1:1. More and more of the barrels of output (or an equivalent energy source) must be used to extract the oil. By the end, there is no net energy production.

There are a few reasons for which this is important:

- It shows that even when the gross output of an oil field is stable, its value can fall off precipitously as the energy cost of extraction rises. This happens as you need to use more and more novel technologies and more and more capital to access the oil.

- EROI has a huge impact on the viability of alternative energy sources. If the ratio for biofuels is only 5:1 or 2:1, that means that enormously more energy must be devoted to producing the same quantity of fuel as was once available in Kuwait at 100:1.

- The combination of oil field depletion and worsening EROI can cause a faster dropoff in production than either factor taken in isolation.

One caveat should be mentioned in closing. There are situations in which an EROI of less than 1:1 is acceptable. Specifically, this is when the final product must have valuable special characteristics. This is true of exotic fuels like, say, sirloin steaks. Each one contains far fewer calories than it took to produce, but that is still economically acceptable due to the premium attached to the calories in the final product. While EROI ratios below 1:1 are acceptable in niche areas, they can never be the energy basis of an entire economy.

Friday, November 14, 2008

The Energy Return of Tar Sands

By sugarcane accounting the EROEI of tar sands is about 5.8 million BTUs (the value of a barrel of oil)/0.8 million BTUs (the approximate energy content of 0.8 MCF that was externally purchased), or 7.25. By true EROEI accounting – which includes the internally consumed energy as an input – the EROEI would be 5.8/1.5 = 3.9.

Of course then the oil has to be refined. For a light, sweet oil such as the output of a syncrude unit, that step is going to be 12/1 or better. Putting the two steps together, I calculate that I need to spend 1.5 million BTUs to produce the oil, and another 5.8/12 = 0.5 million BTUs to refine it to gasoline and diesel. Total process is then 5.8 million BTUs/2 = 2.9/1 for the production and refining processes. Conventional light, sweet oil is around 6/1 for the entire process of oil in the ground to gasoline in the tank.

The energy efficiency of energy procurement systems

Posted by Euan Mearns on February 2, 2009

Small Nuclear Power Plants To Dot the Arctic Circle

Vincent West writes with news of a Russian project currently underway to populate the Arctic Circle with 70-megawatt, floating nuclear power plants. Russia has been planning these nuclear plants for quite some time, with construction beginning on the prototype in 2007. It’s due to be finished next year, and an agreement was reached in February to build four more. According to the Guardian: “The 70-megawatt plants, each of which would consist of two reactors on board giant steel platforms, would provide power to Gazprom, the oil firm which is also Russia’s biggest company. It would allow Gazprom to power drills needed to exploit some of the remotest oil and gas fields in the world in the Barents and Kara seas. The self-propelled vessels would store their own waste and fuel and would need to be serviced only once every 12 to 14 years.”

“Where will the energy come from, as more of the world’s net exporters become net importers?

Britain, Argentina, Indonesia, and others have become net importers in recent years. Mexico and Columbia are expected to follow suit within a decade. Clearly, we can’t all be net energy importers.

There is also the obstinate fact that aggregate net energy — the energy you get in return for investing energy in its production — has been dropping steadily. Oil net energy dropped from 100 in the early 1930s to 11 or less today. Net energy for natural gas is now in decline. We don’t have adequate data to know yet, but coal’s net energy is probably in decline too. Meanwhile, the net energy of all substitutes is low: wind, 18; solar, 6.8; nuclear, 5-15; all biofuels, under 2.

It is not surprising that a study of the Herold database (Gagnon, Hall, and Brinker, 2009) showed the amount of oil and gas produced per dollar spent declined between 1999 and 2006.”

It was only natural for mankind to exploit the cheapest energy sources first, such as easy-to-extract oil reserves under Saudi Arabia. The problem now is not that the world is running out of energy but that the new sources of energy are more expensive to exploit.

The key ratio is “energy return on energy invested”. Analysis by Tim Morgan at Tullett Prebon, a broker, estimates that oil discovered in the 1970s delivered around 30 units of energy for every unit invested. By itself this was well down on the returns from oil discovered in the 1930s, which were nearer 100-to-1. Current oil and gas finds, such as undersea reserves, may offer a return between 16-to-1 and 20-to-1. The return on sources such as tar sands and biofuels like ethanol are in the single digits.